Best-selling author and renowned financial expert, John Mauldin, shares his analysis of investments and economics from his Texas base in Dallas.

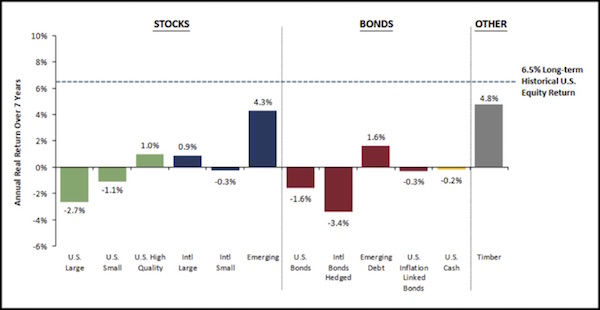

JohnMauldin All bets may be off anyway if the latest long-term return forecasts are correct. Here’s GMO’s latest 7-year asset class forecast:

See that dotted line, the one that not a single asset class gets anywhere near? That’s the 6.5% long-term stock return that many supposedly wise investors tell us is reasonable to expect. GMO doesn’t think it’s reasonable at all, at least not for the next seven years.

If GMO is right – and they usually are – and you’re a devotee of any kind of passive or semi-passive asset allocation strategy, you can expect somewhere around 0% returns over the next seven years – if you’re lucky.

Note also that nearly invisible -0.2% yellow bar for “U.S. Cash.” Negative multi-year real (adjusted for inflation) returns from cash? You bet. Welcome to NIRP, American-style. Would you like that with fries?

The Fed’s fantasies notwithstanding, NIRP is not conducive to “normal” returns in any asset class. GMO says the best bets are emerging-market stocks and timber. Those also happen to be thin markets that everyone can’t hold at once. So, prepare to be stuck.

Given that long-term investment returns have only been 6.5%, it is unrealistic to believe that one can achieve 6.75%, as Texas Municipal Retirement System does. These experts quoted above believe investment returns will be substantially below 6.5% over the next 7 years. Isn't it time for TMRS to reduce their assumed rate of return to more realistic levels? The Georgetown city council needs to introduce the experts at TMRS to present day reality before a crisis is reached for Georgetown's employees and retirees.

Given that long-term investment returns have only been 6.5%, it is unrealistic to believe that one can achieve 6.75%, as Texas Municipal Retirement System does. These experts quoted above believe investment returns will be substantially below 6.5% over the next 7 years. Isn't it time for TMRS to reduce their assumed rate of return to more realistic levels? The Georgetown city council needs to introduce the experts at TMRS to present day reality before a crisis is reached for Georgetown's employees and retirees.

No comments:

Post a Comment